Play Audiobook Sample

Play Audiobook Sample

The Big Short: Inside the Doomsday Machine Audiobook

Play Audiobook Sample

Play Audiobook Sample

This audiobook is no longer available through the publisher and we don't know if or when it will become available again. Please check out similar audiobooks below, and click the "Vote this up!" button to let us know you're interested in this title. This audiobook has 8 votes

Quick Stats About this Audiobook

Total Audiobook Chapters:

Longest Chapter Length:

Shortest Chapter Length:

Average Chapter Length:

Audiobooks by this Author:

Synopsis

Michael Lewis is the writer of Liar's Poker which came out in 1989. Even back then, Lewis was writing about Wall Street and the levels of corruption that existed in that milieu. He freely admitted that he was part of this corrupt movement and boasted about his year-end bonus in that book. In The Big Short: Inside the Doomsday Machine, Lewis gives us yet another insider look at what led to the financial crisis of 2008 which is going to cost the economy several trillion dollars. He does this by following the careers of three people who saw the direction in which the economy was heading and decided to make a killing from it.

There are two character types in financial markets—the long and the short. Whereas the long invests in a security that is not currently doing well in hopes that it will do so in the long run, the short sells off the security whose price, he suspects, is going to plummet and plans to buy it back cheaply at a later date. The stories of Steve Eisman, Michael Burry and Charlie Ledley are examples of those who shorted securities and made several hundreds of million dollars in 2008.

Eisman recognized that the housing market didn't perform the kind of analysis necessary before handing out mortgages and made money by selling off the worst of these. Michael Burry is a doctor with Asperger's who started a fund with some money that came his way as a settlement. He started looking into bonds and, realizing how much lending standards had fallen, made money by shorting subprime mortgage bonds. Charlie Ledley came to the conclusion that the best way to make money was to take the thing Wall Street considered least likely to happen and to bet on its happening.

The Big Short shows how, even when most people believed certain outcomes to be impossible, mavericks like Eisman, Burry and Ledley had the presence of mind to look in a different direction and see what was really going to happen, either through analysis or just by noticing things others didn't. These are stories we can keep in mind to prevent something like the crash of 2008 from happening again.

Lewis was born in New Orleans to a lawyer and a community activist. He went to Princeton University where he studied Art History, and later, he attended the London School of Economics where he got a Master's in Economics. He worked for Salomon brothers before retiring to become a financial journalist. He has written for The New York Times Magazine, The Spectator, Conde Nast Portfolio and Vanity Fair where he is currently a contributing editor. He is the writer of over a dozen books including Moneyball which was made into a hit movie starring Brad Pitt. He has been married three times and currently lives in Berkeley, CA with his third wife, Tabitha Soren and three children.

"Michael Lewis does an amazing job of explaining the crash of 2008 clearly and in an extremely interesting manner. Rather than simply demonizing the investment bankers for their mistakes, he shows the environmental variables that resulted in their actions. While the media or an average person on the street might blame the bankers poor moral judgement, or lack of empathy, Lewis takes a more sociological position and demonstrates the way in which compensation and recognition were structured within the mortgage IBankong industry in a way that encouraged behavior that was not in the long term interest of the market or the firm. Highly recommended for anyone who enjoys a great financial story or wants to understand the catalysts of the 2008 crash and following recession."

— Alexander (5 out of 5 stars)

Quotes

-

“No one writes with more narrative panache about money and finance than Mr. Lewis....[he] does a nimble job of using his subjects’ stories to explicate the greed, idiocies and hypocrisies of a system notably lacking in grown-up supervision.”

— New York Times -

“Superb: Michael Lewis doing what he does best, illuminating the idiocy, madness and greed of modern finance…Lewis achieves what I previously imagined impossible: He makes subprime sexy all over again.”

— Salon -

“[Lewis] returns to his financial roots to excavate the crisis of 2007–2008, employing his trademark technique of casting a microcosmic lens on the personal histories of several Wall Street outsiders who were betting against the grain—to shed light on the macrocosmic tale of greed and fear…Narration duties are assumed by Jesse Boggs… [Boggs] is well suited to the task and trips lightly through a maze of financial jargon.”

— Publishers Weekly -

“Lewis is a capable guide into the world of CDOs, subprime mortgages, head-in-the-sand investments, inflated egos--and the big short.”

— Bookmarks

Awards

-

A 2010 Publishers Weekly Top 10 Book for Nonfiction

-

A USA Today bestseller

-

A #1 New York Times bestseller

-

A 2010 San Francisco Chronicle Best Book for Nonfiction

-

Winner of the 2010 Los Angeles Times Book Prize for Current Interest

-

Winner of the 2011 Robert F. Kennedy Book Award

The Big Short Listener Reviews

- — Ritaham , 11/2/2022

-

" If you've seen the movie but want a more indepth look at the 2008 GFC then this is well worth it. I'm about to go buy more of Lewis' books. "

— sean2e, 9/5/2016 -

" Interesting account of the Sub-prime mortgage crisis. Except for my own money I have little interest in all things financial but this author actually made it interesting. "

— Jack, 2/18/2014 -

" Readable, informative and thoroughly enjoyable stories illustrating the causes of the 2008 financial crisis. "

— Tucker, 2/11/2014 -

" And I thought I had a low opinion of people in finance before... "

— Eric, 2/6/2014 -

" A pretty good little story of the before and middle of the financial crises told through the eyes of a bunch of Wall Street outsiders who profited by "shorting" it (i.e., betting against it). Odd-ball characters. Under-dogs. Nobodies who get rich quick betting on something everyone else bet against. Despite the collapse, Lewis says we're all still screwed. Ultimately you'll wonder if the "The Big Short" refers not to the betting on the housing collapse and subsequent financial panic, but on how the common person is short-changed, no matter how badly financiers muck things up. Nothing profound, but still, it's interesting. "

— Jake, 2/5/2014 -

" Just another BORING book talking about the 2007 sub-prime crisis. why not writing more forward-looking books on solutions on how to get out of the crisis? "

— Victor, 2/1/2014 -

" Michael Lewis's 'The Big Short' is a fascinating summarization of all that went wrong in the real estate derivative markets, essentially leading to the financial meltdown fueled by the so-called credit default swap market. It is also incredulous in its honest caricature of bond sellers being blatantly ignorant of what they were betting on, and what the stakes are. The culprits include a variety of banking institutions, which makes the case, and the story, that much more incredible. A few people predicated the mess, and some of them even bet against it, but as Michael makes clear, this is one of the those situations where saying 'I told you so' is not helpful, because the ones who suffered are ordinary people whose role in the game was entirely unintentional. "

— Vaishak, 1/26/2014 -

" This was a very informative book that describes the origins (and perpetrators) of the subprime mortgage market which produced the great recession and the stock market crash in 2008. FYI, it all began in the late 90s. Michael Lewis actually makes it interesting. "

— John, 1/23/2014 -

" Interesting expose of sleazy people "

— Gary, 1/20/2014 -

" A fascinating account that personifies the financial crisis. For me, the numbers now have faces. LOVED! "

— Princesa_ksc, 1/16/2014

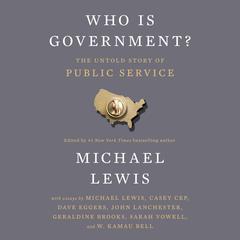

About Michael Lewis

Michael Lewis is the New York Times bestselling author of several books. His global bestselling books lift the lid on the biggest stories of our time. They include Flash Boys, an exposé of high-speed scamming; The Big Short, which was made into a Oscar-winning film; Liar’s Poker, the book that defined the excesses of the 1980s; The Fifth Risk, revealing what happens when democracy unravels, and The Premonition, one of the first books to take account of the coronavirus pandemic. He was educated at Princeton University and the London School of Economics.